- Current price movements suggest the token could drop further to find a stronger support level.

- Reduced liquidity indicates a near-term pullback is likely with other indicators point to sustained overall bullish momentum.

In the last 24 hours, Brett [BRETT] has gained approximately 6%, according to CoinMarketCap. However, key bearish signals suggest the asset may extend its monthly loss of 16.28% in the short term.

AMBCrypto notes that while a decline appears possible, signs of recovery are evident, with the potential for BRETT to reach a new market high in the long run.

A decline followed by a rally for BRETT

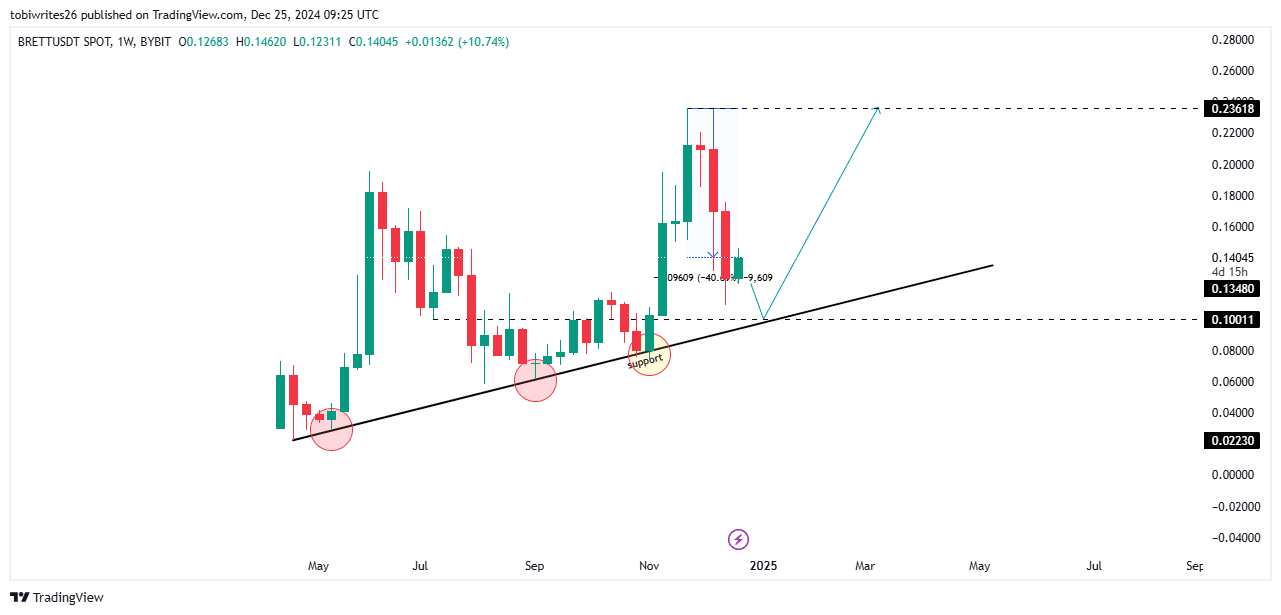

After reaching a new all-time high of $0.236 in November, BRETT has since dropped by at least 40%, according to the chart. This loss is expected to extend toward a key support level.

Given this, the recent formation of a green candle on the weekly chart suggests a temporary retracement before the asset resumes its downward movement.

This decline is likely to lead the price toward the support level, which has previously acted as a catalyst for upward movement on three separate occasions.

Based on this historical pattern, a similar rally is expected, potentially bringing BRETT back to at least $0.236.

AMBCrypto observes that while BRETT’s potential drop is driven by lower liquidity, the overall bullish sentiment remains strong in the market.

Liquidity declines, BRETT falls, but remains resilient

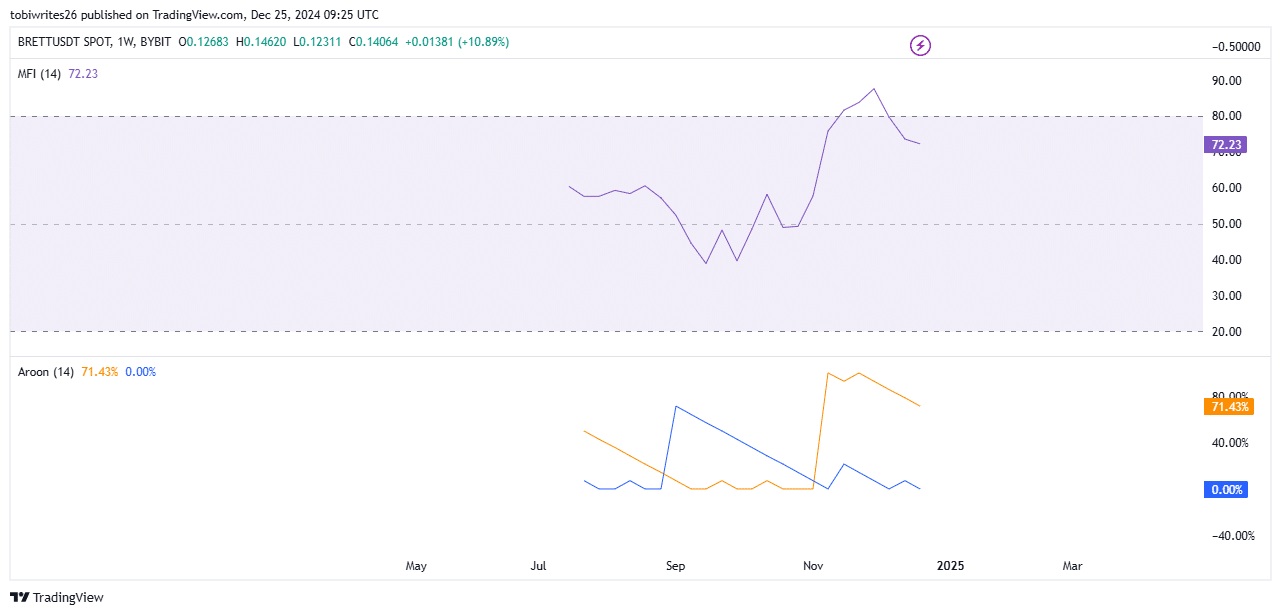

The Money Flow Index (MFI), a technical indicator measuring the inflow and outflow of funds into an asset, has started to drop after BRETT entered the overbought territory above 80.

Currently, the MFI stands at 72.23 and is trending downwards, indicating a reduction in liquidity flowing into the asset. As a result, BRETT is expected to experience a decline.

However, the MFI remains in the positive zone, suggesting the asset is still positioned for a potential recovery.

The Aroon Indicator further supports the bullish outlook for BRETT. As of now, the Aroon Up (orange line) is at 71.43%, well above the Aroon Down (blue line) at 0.00%. When Aroon Up exceeds Aroon Down, it signals that the market remains bullish.

Given the current technical indicators, BRETT is likely to fall to the support level on the chart after further liquidity outflow. However, its bullish structure will be maintained as long as the MFI stays above the neutral zone at 50.00 and the Aroon Up remains elevated.

Large holders are not buying BRETT

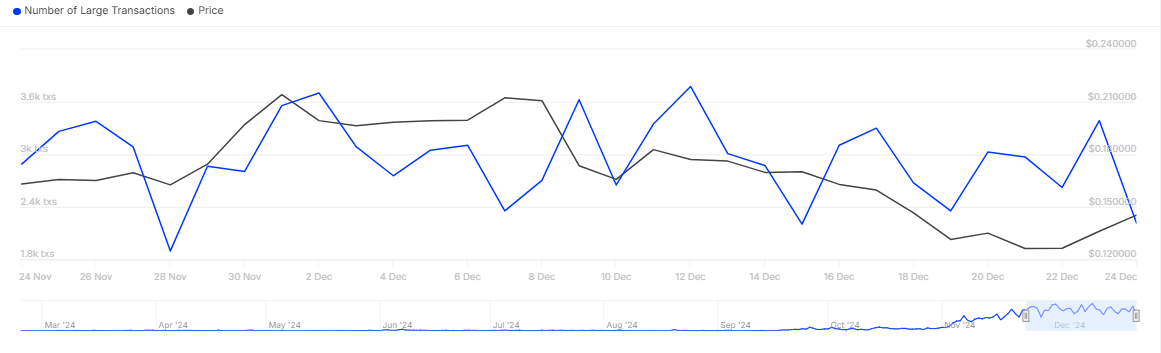

Data from IntoTheBlock highlights a sharp decline in large transactions and trading volume. In the last 24 hours, 2,220 large transactions occurred, totaling 3.86 billion BRETT ($56.47 million).

Read Brett’s [BRETT] Price Prediction 2024–2025

Normally, such large transactions would trigger a significant price increase, but the market has reacted sluggishly, suggesting that major holders are not currently interested in purchasing BRETT.

If this trend continues, it could lead to further price declines, pushing BRETT toward the support level before a potential market rally toward higher prices.