- A spike in Solana’s transaction fees and a sharp decline in transaction count have contributed to bearish market sentiment.

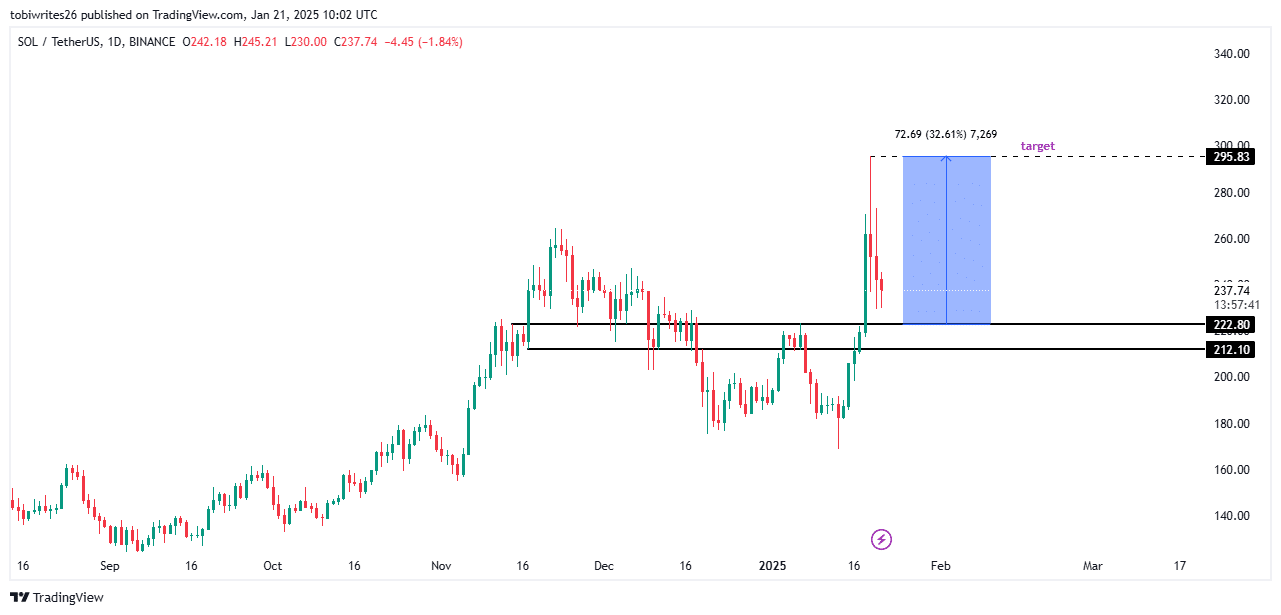

- SOL could test the $222 support level before attempting a recovery.

In the past few weeks, Solana [SOL] enjoyed an impressive rally, gaining 28.20%, which propelled it to a new all-time high of $294.33 on the 19th of January. However, the token has since declined by 18.75%.

According to analysis by AMBCrypto, key metrics currently suggest unfavorable conditions for SOL, with the possibility of further declines in the near term.

Downtime could impact SOL’s gains

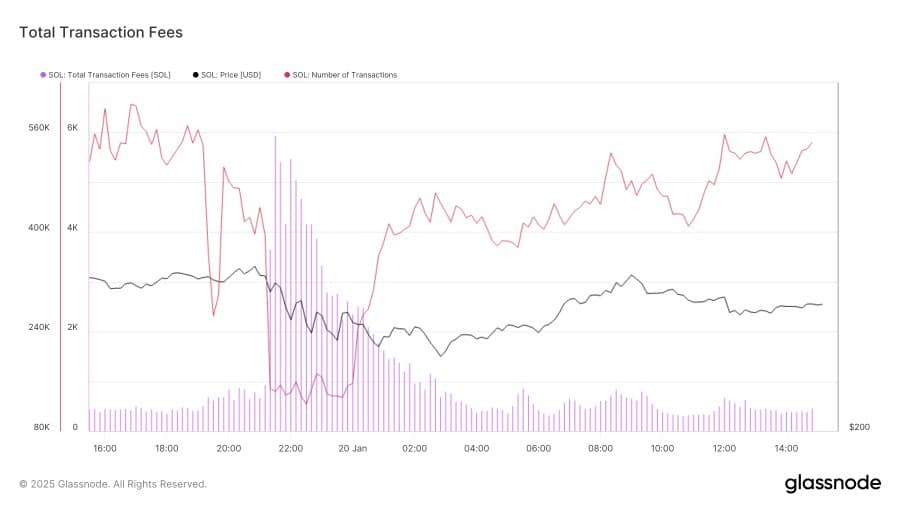

According to Glassnode, the Solana blockchain recently hit an unprecedented milestone as transaction fees surged significantly within a short period, following the launch of the TRUMP token.

Data reveals that 6,000 SOL—worth approximately $1.4 million (based on SOL’s press-time value of $239.55)—was paid in fees within just 10 minutes, marking a record high for the network.

This spike in fees saw the number of transactions on the network decline sharply during the same timeframe. Transaction count dropped from 450,000 to 150,000—a difference of 300,000 transactions.

This decrease signals reduced network activity and drop in market interest.

A pattern such as this often precede price declines, a trend currently affecting SOL, contributing to its 11.86% drop in the past 24 hours.

Liquidity outflow impacts SOL

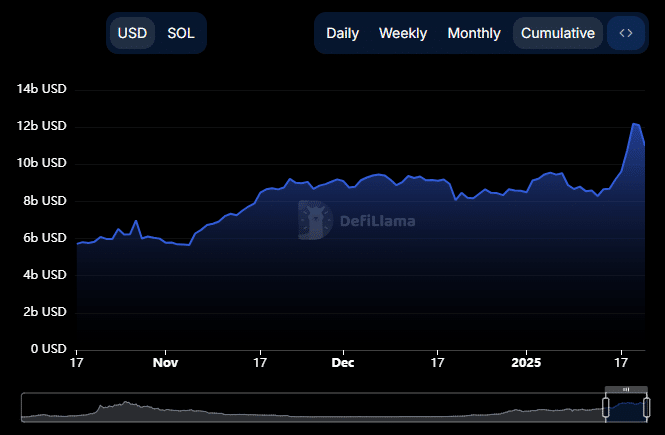

The decline in transaction count and waning interest in Solana has coincided with a significant drop in the network’s Total Value Locked (TVL), which measures the funds deposited in liquidity pools and protocols on the chain.

Since the 19th of January, when Solana’s TVL peaked at an all-time high of $12.191 billion, it has dropped to $10.964 billion—a substantial outflow of $1.227 billion.

This decline reflects reduced investor confidence in SOL, leading to increased selling pressure and a rise in circulating supply.

With the TVL trending downward, the drop appears far from over, suggesting that further declines are possible as bearish sentiment persists.

AMBCrypto’s analysis identified a potential support level below, which could provide insight into how much further the TVL might fall.

SOL risks a fall to the $222 region

On the chart, SOL could decline to a demand zone between $222.80 and $210.10—a region that may act as a catalyst for an upward price movement.

Read Solana’s [SOL] Price Prediction 2025–2026

If SOL reaches this zone and maintains support, it could stage a rebound toward its recently established all-time high. A positive reaction at this level could trigger a 72.69% rally.

However, if bearish sentiment intensifies and the demand zone fails to hold, SOL may drop further from its current price level.