MORPHO traded at $1.40 at the time of writing after gaining 16% in the past 24 hours, while trading volume rose to $41.25M, confirming expanding participation behind the move.

Market capitalization stood at $532.77M, reflecting a 14.03% increase and signaling renewed capital inflows.

Meanwhile, the CMC Altcoin Season Index has surged 54.55% this week to 34, highlighting capital rotation from Bitcoin into higher-risk altcoins.

MORPHO’s 16% weekly gain significantly outpaces the broader market’s 2.7% rise, reinforcing its strong beta positioning within this rotation.

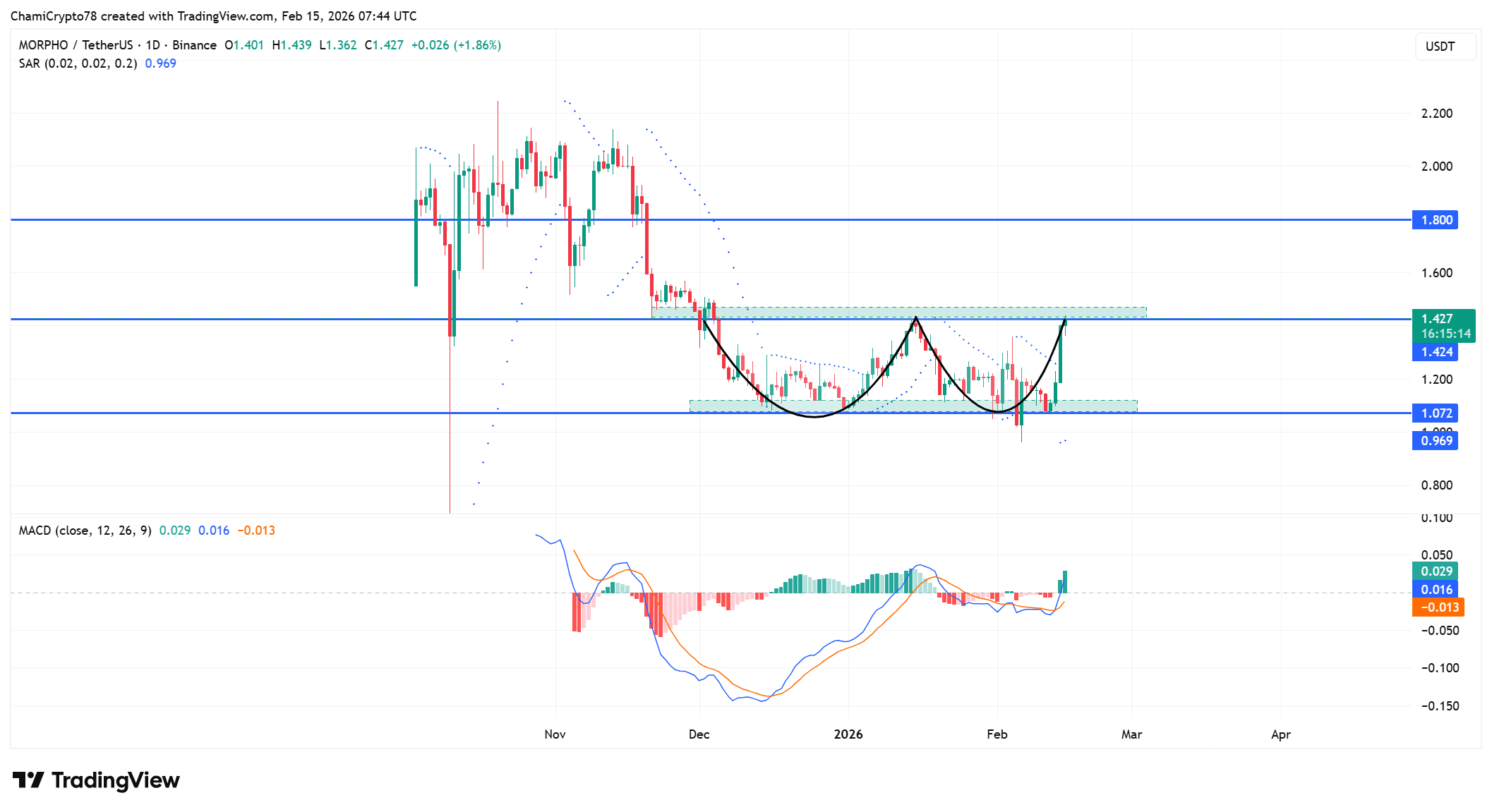

Double-bottom confirmed as price presses into supply

MORPHO has completed a clear double-bottom formation after defending the $1.07 demand zone twice and reclaiming the $1.42 neckline with conviction.

The neckline now overlaps with a defined supply region, placing price at a structurally decisive level.

Buyers continue pressing into this resistance cluster in an attempt to convert prior distribution into acceptance.

Sustained strength above $1.42 would expose the next major horizontal barrier near $1.80, where price previously faced rejection.

However, failure to hold above the neckline could invite renewed selling pressure toward $1.07.

The symmetry of the structure and the strength of the reaction lows point toward deliberate accumulation rather than random volatility.

MACD has rotated into positive territory, with the histogram printing expanding green bars while the signal line trends upward.

This crossover marks a meaningful transition from prolonged downside compression into renewed bullish momentum.

During the earlier decline, MACD remained deeply negative and reinforced persistent selling pressure.

Now momentum aligns with structural recovery as price challenges resistance. The histogram had not flattened; instead, it continued expanding, which signals strengthening participation rather than a temporary relief bounce.

Besides, the Parabolic SAR has flipped below price, confirming a short-term trend reversal and reinforcing buyer control as long as candles hold above the SAR dots.

If this momentum expansion sustains while price tests supply, the technical structure increasingly favors continuation over rejection.

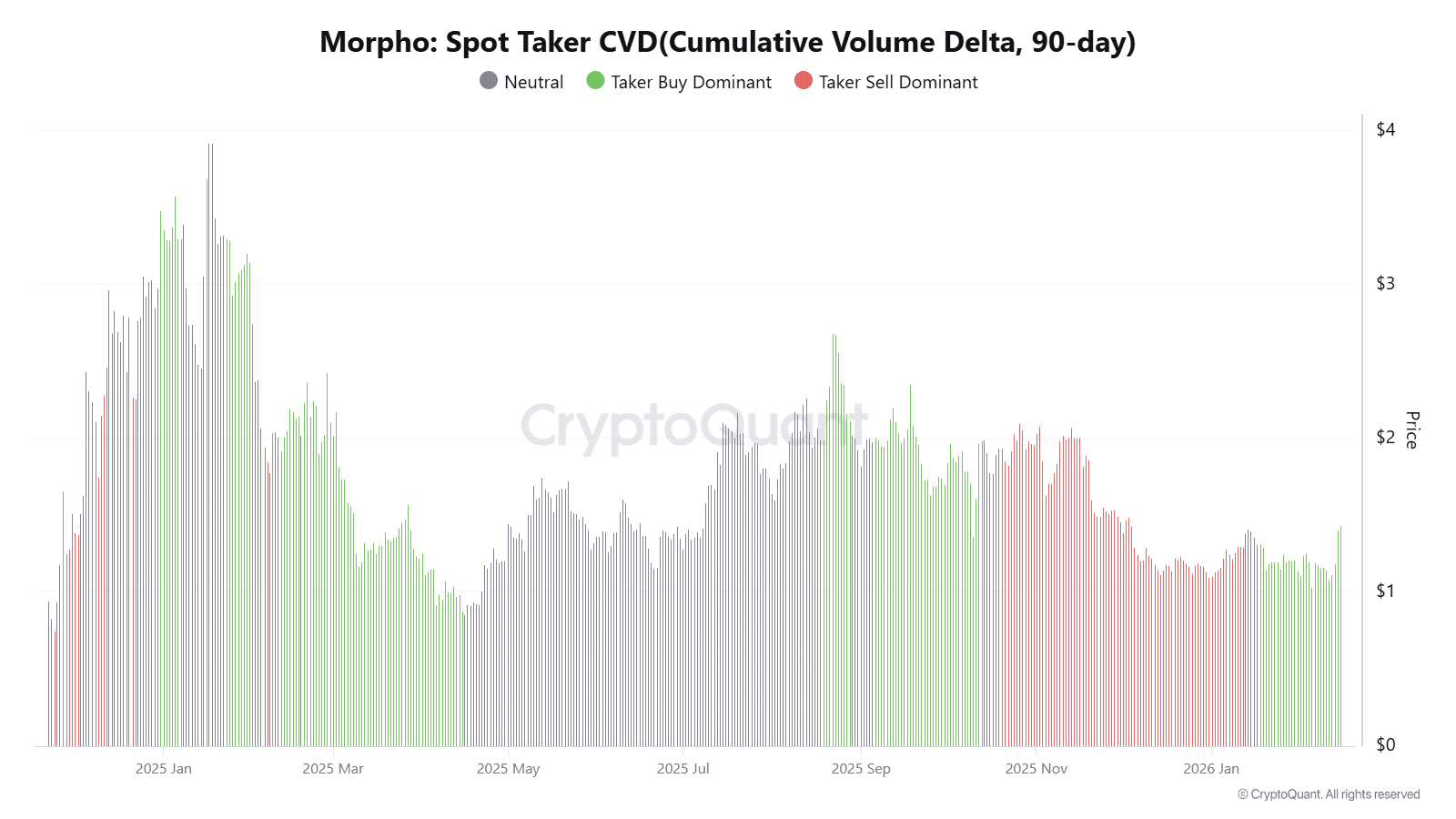

Buyer aggression persists as taker CVD supports price

The 90-day Spot Taker CVD continues to show dominant buyer activity, signaling aggressive market orders absorbing available liquidity.

This dynamic reflects conviction rather than passive positioning, particularly as price advances toward resistance.

Although participation cooled briefly in earlier sessions, the renewed 24-hour volume of $41.25M now aligns with price expansion, which reduces divergence risk.

Buyers continue executing through market orders, reinforcing upward pressure rather than hesitating at resistance.

When taker dominance persists during structural compression, it often precedes decisive resolution.

Continued absorption near $1.42 would increase the likelihood of supply exhaustion rather than immediate rejection.

Open Interest expands sharply as leverage builds

Open Interest has surged 25.99% to $29.80M, signaling a strong return of leveraged participation into the current move.

Rising Open Interest alongside price expansion typically reflects directional conviction rather than short covering.

However, deploying leverage into resistance increases volatility potential if price fails to secure acceptance.

A decisive breakout above $1.42 could accelerate upside momentum toward $1.80 as leveraged positions amplify continuation. Conversely, rejection at supply could trigger liquidations and intensify downside pressure.

The alignment between structural testing and derivatives expansion creates a high-impact moment that will likely determine the next major move.

Positive funding reflects strengthening long bias

The OI-Weighted Funding Rate printed positive near 0.005% at the time of writing, indicating that long positions pay shorts and that bullish sentiment dominates derivatives markets.

This shift marked a clear rotation from earlier negative extremes. Moderate positive funding during structural breakout attempts generally confirm conviction rather than excess.

At the time of writing, funding remained constructive without signaling overcrowding. Traders maintain long exposure as price presses into supply, which supports continuation potential.

If funding sustains moderate positivity while price clears resistance, the broader bullish structure would gain stronger confirmation.

A brief overview

MORPHO has aligned structural completion, momentum expansion, buyer dominance, rising Open Interest, and positive funding behind its current advance.

Broader altcoin rotation strengthens the macro backdrop and supports sustained interest in higher-beta assets.

If buyers secure acceptance above the $1.42 supply zone, price would likely advance toward $1.80 with reinforcing momentum.

However, failure to hold this region could trigger renewed pressure toward $1.07 demand. Current confluence favors continuation, yet decisive resolution at resistance will ultimately determine the durability of this rally.

Final Summary

- Structural strength, momentum expansion, and rising derivatives conviction now align firmly behind this breakout attempt at key resistance.

- Clear acceptance above supply would reshape market psychology and establish $1.80 as the next meaningful upside objective.